Part 3 of 3; part 2 is here; part 1 is here.

Yesterday, the pro-Amendment 7 campaign committee, Missourians for Safe Transportation and New Jobs, received donations totaling $97,500. That's yesterday alone. Since the committee's inception, it's raised $586,022. According to Scott Cannon of the Kansas City Star, financial support of the pro-Amendment 7 effort is expected to total "upward of $5 million."

Meanwhile, the anti-Amendment 7 campaign committee, Missourians for Better Transportation Solutions, "likely will rely on social media and public events."

The pro-Amendment 7 committee has Normington & Petts, a DC-based polling and strategy firm with a load of experience winning tough races. It also has valuable experience in statewide Missouri campaigns, as it polled and consulted for Jay Nixon's victorious 2008 campaign for governor.

That's not to say that the dramatic resource disparity of the pro- and anti-7 campaigns automatically makes passage a slam dunk. Conventional Missouri political wisdom holds that Missouri's August primary electorate has a generally anti-tax disposition. Nevertheless, the dramatic resource disparity very well could "level the playing field," if not tilt the playing field in the pro-7 forces' favor.

And a "level playing field" very well could be sufficient to pass Amendment 7. The pro-7 forces need for success but a bare majority: 50% of Missouri's August 5th voters plus one.

And that's the St. Louis regional transportation policy dice-roll. St. Louis' multi-modal transportation advocates have decided to put their public organization efforts seemingly entirely into defeating Amendment 7 on August 5th rather than recently-and-now organizing public pressure on the County Executive's Office for a more multi-modal County project list. St. Louis' multi-modal transportation advocates should hope that they've correctly assessed the potential outcomes and have strategized accordingly. The stakes in this dice-roll are the next ten years (at least) of St. Louis regional transportation policy.

Wednesday, June 11, 2014

Tuesday, June 10, 2014

MO Transpo Tax Part 2: Sales Tax in the City (and County)

Part 2 of 3; Part 1 is here.

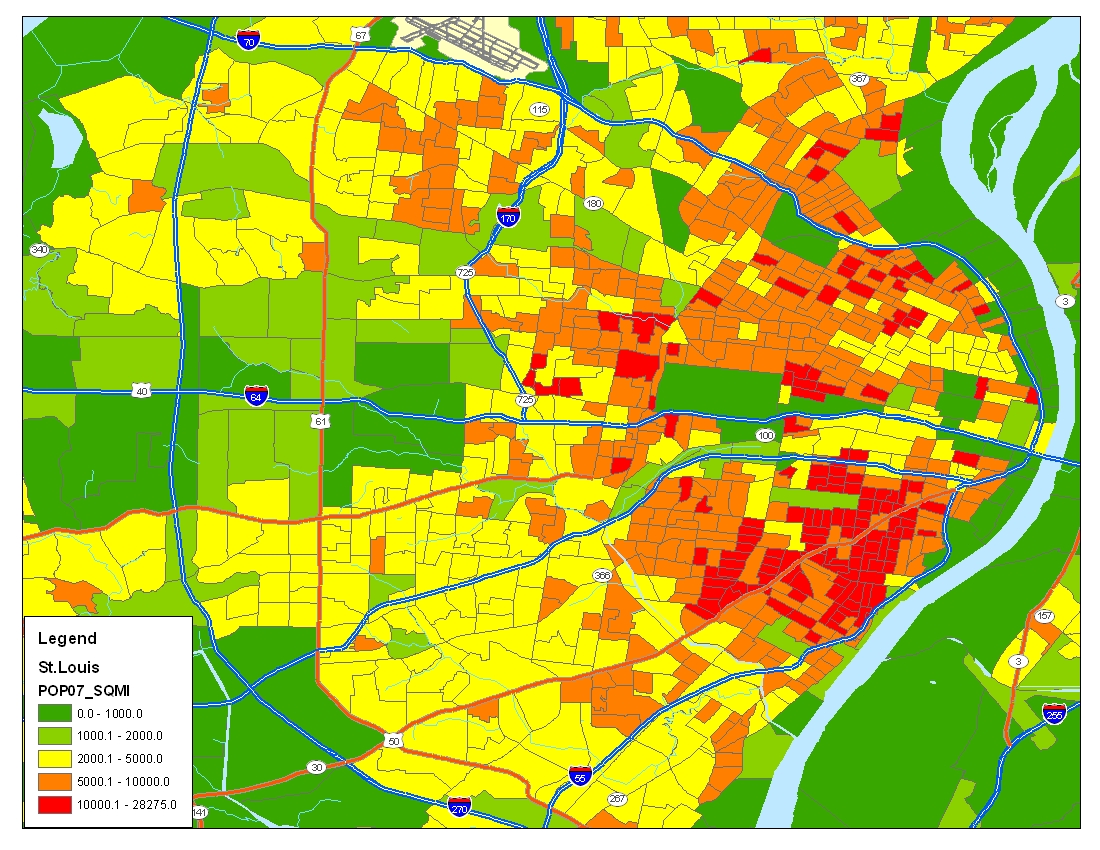

While a sales tax may be less regressive than a fuel tax in rural Missouri, a sales tax is still regressive in rural Missouri. In urban and inner-ring suburban St. Louis, the opposite relationship tends to occur. A sales tax is more regressive than a fuel tax in urban/inner-ring suburban St. Louis (though a fuel tax would be regressive, too).

For Missouri communities more urban in character, state sales tax revenue can do things that fuel tax revenue cannot. Missouri gasoline/diesel taxes can only be used for roads, per Article IV Section 30(a) of the Missouri Constitution. Missouri sales tax revenue isn't limited as such, and can be used for any kind of transportation infrastructure such as mass transit, bicycle, pedestrian, river, air, etc. In the Mayor's words, state sales tax revenue provides for flexibility:

Room 200's list of projects submitted to MoDOT takes large advantage of the flexibility afforded by sales tax revenue as opposed to gasoline/diesel tax revenue. Only 25% of the City's "90%" category allotment of revenue ($255 million) would go to road and bridge projects. The other 75% (of $255 million) would go to Complete Streets projects, transit projects, bicyle/pedestrian path projects, airport projects, river port projects and a law enforcement "total transportation center." The City of St. Louis is further projected to receive an additional $2.5 million per year in discretionary, flexible transportation funds.

In St. Louis County, it's a different story.

After a issuing a statement that the Missouri transportation sales tax issue is "not a top priority" for his administration, the County Executive (at least figuratively) mailed it in to MoDOT. Alex Ihnen's nextSTL piece estimates that approximately 98% of the County's "90%" category allotment of revenue ($841 million) would go to road and bridge projects. It's almost as if the County's "90%" category allotment might as well be gasoline/diesel tax revenue.

Obscured in the story so far has been the fact that these "90%" category county project lists are not final until approved by the Missouri Highways and Transportation Commission upon presentation by MoDOT's district heads. There was and is still both time and opportunity for a more multi-modal set of projects for St. Louis County.

It appears to me here that City Aldermanic President Reed refers to the County Executive Office's current ability to revise and/or amend the County project list:

Instead, efforts at organizing the public for "better transportation solutions" are going toward a campaign to mobilize votes against the state-wide measure, 56 days from now, on August 5th.

While a sales tax may be less regressive than a fuel tax in rural Missouri, a sales tax is still regressive in rural Missouri. In urban and inner-ring suburban St. Louis, the opposite relationship tends to occur. A sales tax is more regressive than a fuel tax in urban/inner-ring suburban St. Louis (though a fuel tax would be regressive, too).

For Missouri communities more urban in character, state sales tax revenue can do things that fuel tax revenue cannot. Missouri gasoline/diesel taxes can only be used for roads, per Article IV Section 30(a) of the Missouri Constitution. Missouri sales tax revenue isn't limited as such, and can be used for any kind of transportation infrastructure such as mass transit, bicycle, pedestrian, river, air, etc. In the Mayor's words, state sales tax revenue provides for flexibility:

Room 200's list of projects submitted to MoDOT takes large advantage of the flexibility afforded by sales tax revenue as opposed to gasoline/diesel tax revenue. Only 25% of the City's "90%" category allotment of revenue ($255 million) would go to road and bridge projects. The other 75% (of $255 million) would go to Complete Streets projects, transit projects, bicyle/pedestrian path projects, airport projects, river port projects and a law enforcement "total transportation center." The City of St. Louis is further projected to receive an additional $2.5 million per year in discretionary, flexible transportation funds.

In St. Louis County, it's a different story.

After a issuing a statement that the Missouri transportation sales tax issue is "not a top priority" for his administration, the County Executive (at least figuratively) mailed it in to MoDOT. Alex Ihnen's nextSTL piece estimates that approximately 98% of the County's "90%" category allotment of revenue ($841 million) would go to road and bridge projects. It's almost as if the County's "90%" category allotment might as well be gasoline/diesel tax revenue.

Obscured in the story so far has been the fact that these "90%" category county project lists are not final until approved by the Missouri Highways and Transportation Commission upon presentation by MoDOT's district heads. There was and is still both time and opportunity for a more multi-modal set of projects for St. Louis County.

It appears to me here that City Aldermanic President Reed refers to the County Executive Office's current ability to revise and/or amend the County project list:

@mattfredstl @dbeganovic timeline seems too short for any major changes to the project lists. Tho, fingers crossed @SaintLouCo will amend.

— Lewis E. Reed (@PresReed) June 6, 2014

It's anyone's guess as to what, if any, revisions or amendments the County Executive's Office will make to the County list. What's apparent is the lack of an effort to organize public pressure on the County Executive's Office to take a more multi-modal transportation approach that would be in line with the Mayor's Office's approach.Instead, efforts at organizing the public for "better transportation solutions" are going toward a campaign to mobilize votes against the state-wide measure, 56 days from now, on August 5th.

Friday, June 6, 2014

MO Transpo Tax Part 1: Rural Road Politics

|

| MSR "farm-to-market" road in Nodaway County, Missouri (2012) |

In order to understand the politics of the proposed Missouri 10-year transportation 0.75% sales tax (Amendment 7), start at the Missouri Supplemental Route. This is the MoDOT-maintained system of single and double-lettered roads (i.e. "A" or "BB") that you drive on mostly in rural Missouri. The MSR system of roads is "within 2 miles of more than 95% of all [rural Missouri] farm houses, schools, churches, cemeteries and stores." Many-to-most of the roads in the MSR system could be called "farm-to-market" roads.

Since 2011 when, due to budget cuts, MoDOT commenced its "5 year plan" of cuts of maintenance facilities and workers, the MSR system roads have degraded and continue to degrade. (Ask anybody who uses the MSR system in rural Missouri, and they'll confirm it. I've noticed it.) Depending on who you believe, the degradation of the MSR road system is either the natural result of MoDOT's dramatically-reduced budget, capital and labor capacity ... or a manufactured crisis in service of "Big Concrete." (Consider me insufficiently informed as to causation and therefore agnostic.)

Manufactured or not, it's pretty bad right now (and appearing only to get worse) for communities that depend on the MSR system. At the same time, the communities that the MSR system serve are communities where a fuel tax would hit much harder economically than would a sales tax. By communities, I mean to include not only ordinary people but also the agricultural & ranching industry.

Both this time and the last time (when the transportation sales tax measure failed to move out of the legislature and onto the ballot), rural-based interests (i.e. Missouri Farm Bureau) and rural-based legislators (i.e. Hinson in the House and Kehoe in the Senate) have initiated the drive for a transportation sales tax. Any tax is tough, but a sales tax is least tough on rural Missouri's people and industry when a fuel tax is the alternative. It's both a pocketbook issue and a bottom line issue.

And the MSR roads are bad and getting worse ...

Subscribe to:

Posts (Atom)